The transformation seen in the cloud for financial services has been nothing short of phenomenal especially during the last few years. Then when the pandemic hit, cloud services were in such demand that many financial institutions were impressed with the ease with which their workforce was easily able to transition to remote office work without too many hiccups as an “underlying digital transformation” had begun years ago to help modernize the workplace.

Beyond the obvious Zoom meetings and collaboration tools flooding the market both before and during the pandemic, it was obvious that a trend towards greater reliance on cloud basedservices was underway in the financial world. These shifts were seen as advantages from the past where the big banks were at first reluctant to take the big leap into cloud, whereas now are being public about their adoption of cloud tech. For many big banks, it was a question of staying competitive and relevant in an area that has long been reluctant to any rapid changes in procedures and manners of handling sensitive customer data. The notion of putting sensitive information into a product that few were familiar with until cloud technology spread through the workforce at all levels made many in the C-suite nervous about security protocols and relied heavily on outside consultants and their internal IT security experts to educate, innovate, and manage the process of ensuring data security and privacy at all costs.

Flexibility Allows Scalability

The times have changed. Enterprise migration into the cloud has made it easier for large and small fintech firms as well as large traditional banks and other finserv institutions to streamline their workflows and innovate faster and in more seamless ways than before. The implications have been nothing short of impressive and in some cases mind boggling. According to Bloomberg, cloud adoption though in it’s early stages is still happening at a fairly robust rate, as 22% of ALL applications are now run on the cloud with more room to grow. According to the IDG Cloud Computing Study (2020), almost 55% of all financial firms and fintech companies are using multiple public clouds.

Fintechs are often rapidly growing platforms. This means they need an infrastructure that can grow with them and not put up unnecessary barriers or create challenges where there needn’t be any. Cloud technology provides the agility to scale relatively easily while saving on on-premises technology infrastructure, which can be more costly to upgrade. Even for traditional banking structures, the cloud platform delivers the capacity to adapt to branch closures while still providing services to as many people as possible. Moving infrastructure to the cloud measures accessibility, flexibility, and scalability for both fintechs and financial giants.

Another stunning figure is that these companies are dedicating 32% of their IT budgets to cloud migration and other cloud related services. It’s easy to see why this sector is finally running along with other industries in being cloud savvy. Moving to the cloud is allowing for more agile applications, more growth, more scalability and along with all that comes innovation.

Innovation

As mentioned in Bloomberg: Increasingly, businesses are developing innovations that wouldn’t necessarily be possible without the cloud: enabling fintechs to get up and running faster and offer individualized services, which has encouraged a revolution in financial services. This shift is undoubtedly broadening the competitive landscape. Many also say that agility is a major reason for seeing movement to the cloud.

Companies can now harness the resources as needed which allows for more development of applications in quicker more nimble and secure environments. As of late, even large banks are moving at a more rapid pace and sharing data like startups in the industry. Since cloud technology offers companies more options with less risk, as well as more experimentation and invention on behalf of customers, it’s possible to explore alternative data sets and spend time and capital on proprietary analysis.

New Security & Privacy Options

Despite early concerns about security and data protection, the cloud has proved reasonably secure if the right measures are taken. Zero-trust verification and encrypted data have increased cloud security in recent years. When used alongside measures such as employee education and access control, among others, the cloud proves itself no riskier than traditional IT infrastructure setups. For fintech providers, no doubt, security is at the forefront of their minds when adopting new technology, and it’s vital they ensure their systems have adequate measures in place. The financial services sector has a responsibility to safeguard the data of its customers and the cloud is enhancing the way financial businesses do this. From data encryption to zero trust verification and access control, many of the risks that traditional on-premises IT infrastructures present are being mitigated through cloud computing in financial services.

According to Bloomberg “As migrating data, storing data, and using additional services like machine learning on the cloud becomes more ubiquitous, there’s a clear and demonstrated need for organizational oversight. Many of the tools needed to keep data confidential and secure are readily available within public clouds, enabling firms to take advantage of better security than what is available on their local servers, if they plan appropriately.”

Data Management

Acquiring and working with data is a top priority, from onboarding and identity verification processes to account management, balance, checking, analyzing spending habits, etc. Data is key. Companies can use cloud technology to gather and store large quantities of data securely and make it accessible at any time. That means there’s no need to wait for an IT specialist to clock in to access vital information, providing an employee has the correct credentials. This can be done from anywhere at any time and often automatically.

Best Practices For Cloud Adoption In Finance

Working with more documentation and creating, storing and sharing a great amount of financial information make cloud adoption in banking and fintech specific. Here are the things to consider:

- Encryption and access control: Discuss encryption policies and procedures with your provider to select the technically feasible ones and properly protect the financial data you transmit.

- Compliance: Finance executives need to ask providers to demonstrate compliance certificates of the cloud service.

- Data segregation and data management: Cloud services thrive on shared resources, though financial institutions may require a combo of shared resource benefits with the increased security reached by data segregation.

- Disaster recovery plan: Reputable service providers always have it in place, and it’s important to obtain a detailed disaster recovery plan and ensure your digital infrastructure allows all that.

How GoDgtl Partners with the major cloud providers AWS, Azure, and Google

GoDgtl brings a team of experienced cloud experts who work directly with AWS, Azure, and Google to bring value and real solutions for your cloud projects. With direct access to resources and in house cloud consulting talent, GoDgtl is ready to guide you through your financial/fintech cloud journey regardless of where you are on that path. Whether it’s more knowledge-based information on cloud topics such as security, or governance and compliance or basic cloud migration aspects or even if an assessment is needed, GoDgtl can provide a roadmap for your path to project completion and success.

Sources:

https://www.pwc.com/us/en/industries/financial-services/cloud.html

https://www.telehouse.net/blog/the-impact-of-cloud-computing-in-fintech/

Recent Posts

December, 2021

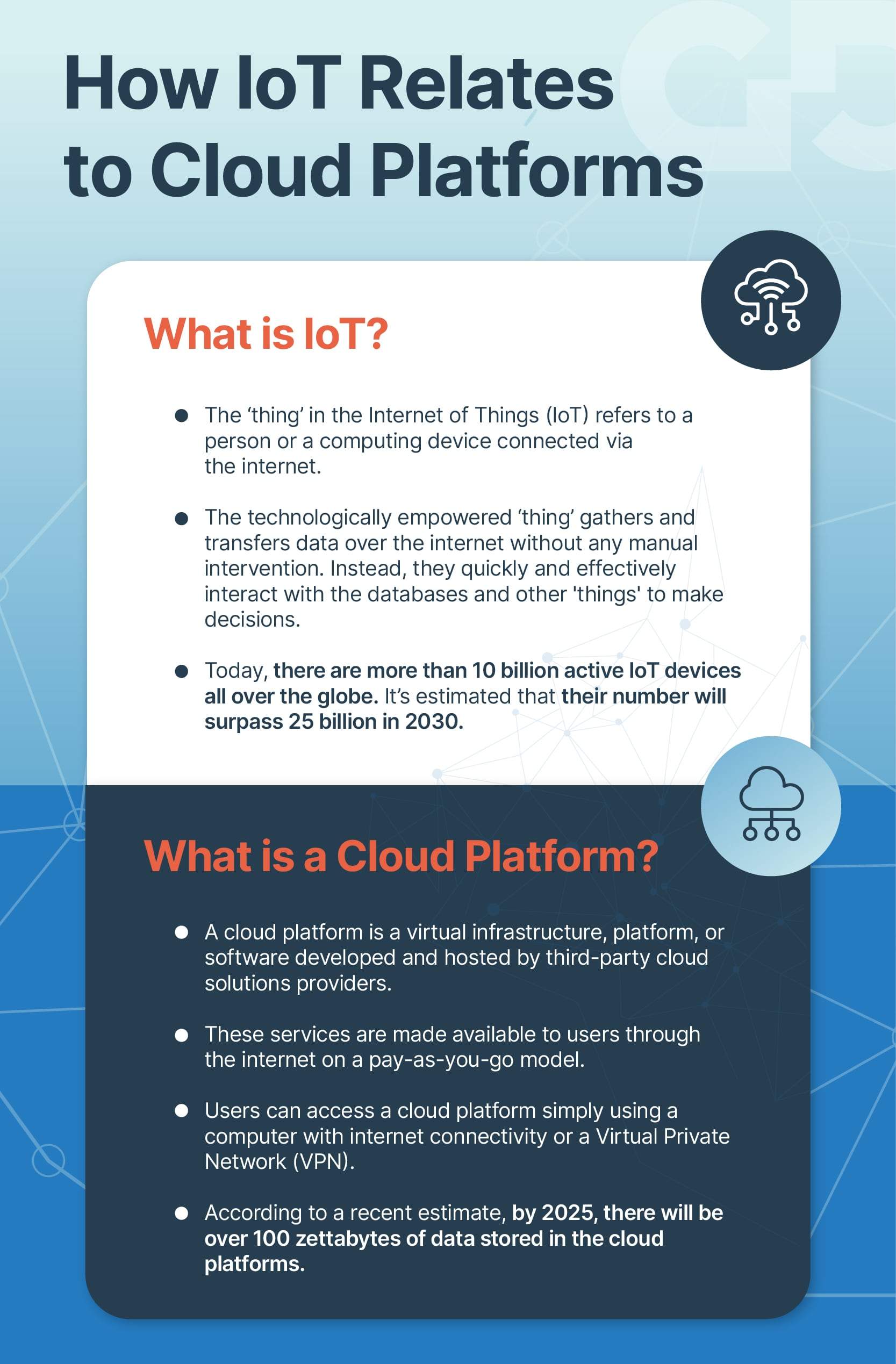

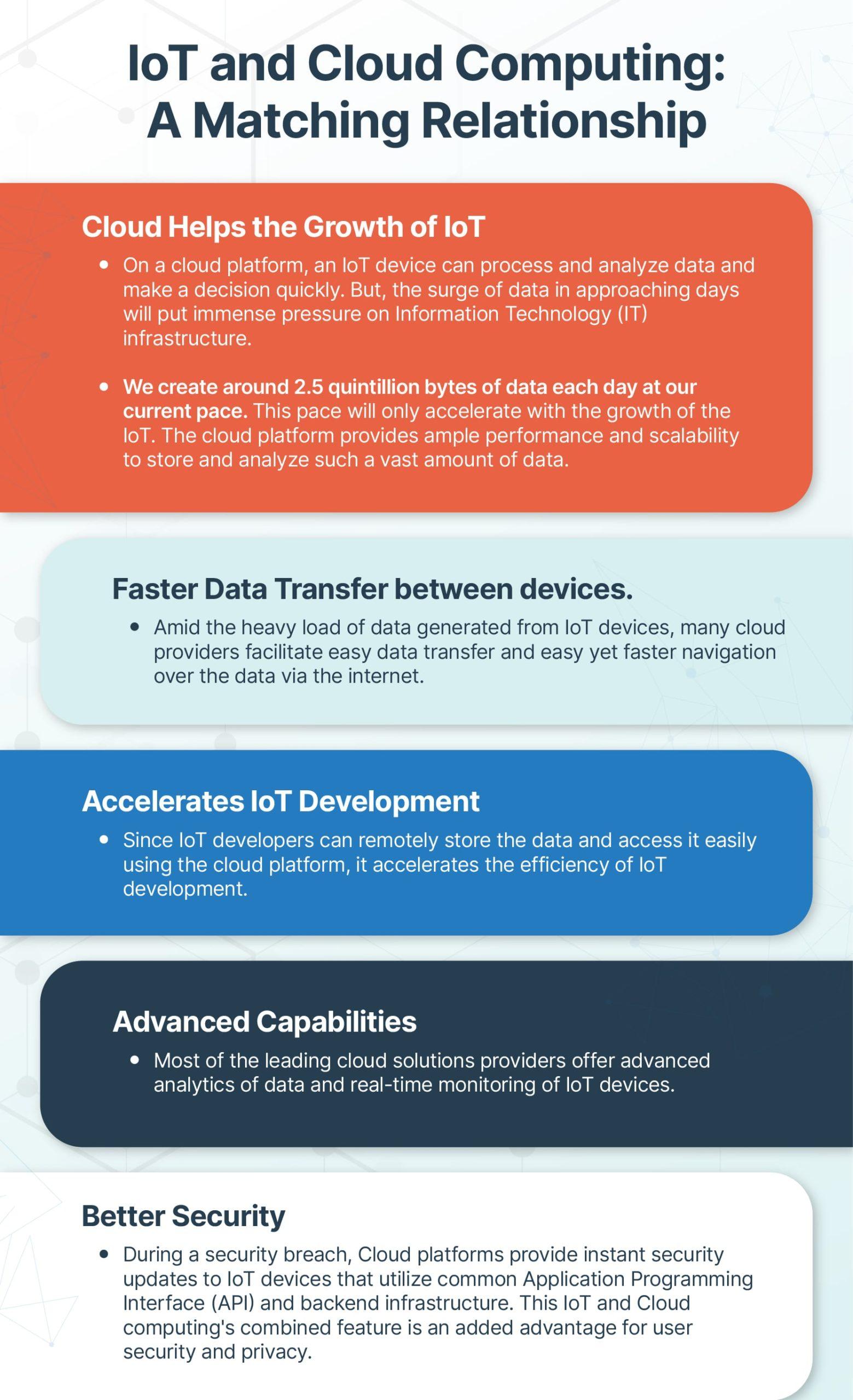

The adoption of IoT (Internet of Things) has rapidly changed today’s business world. IoT predominantly helps to capture vast volumes of data from multiple sources. However, the processes of collecting, processing, and analyzing the tremendous flow of data from countless IoT devices have turned complex.

The data-driven nature of present-day businesses requires investments in innovative technologies that can turn this complex process into a simplified yet easily comprehensible one. This is the point where the convergence of IoT and Artificial Intelligence (AI) or AIoT can play a major role in redefining how businesses and economies work.

While IoT comprises devices interacting over the internet, the Machine Learning (ML) capabilities of AI make IoT devices learn from the data they collect. AI-enabled intelligent IoT devices can simulate smart human (at times, superhuman) behavior and decision-making patterns with little or no human interference.

The Rising Trend of IoT and AI Convergence

As a prominent part of their business processes, several businesses worldwide have already embraced the combination of IoT and AI. A 2019 survey reveals that respondents that heavily use AI in their IoT operations exceeded their value expectations. Similarly, a PwC 2019 IoT survey shows that 97% of the companies that have integrated IoT with other technologies such as AI and Blockchain were able to reap the benefits through this investment.

Start-ups and large enterprises alike prefer AI technology to bring out the full potential of IoT. The major leading providers of IoT platforms like Oracle, Amazon, and Microsoft have begun incorporating AI technology into their IoT applications already.

From robotics, self-driving cars and advanced analytics to Industry 4.0 Digital Twins and smart IoT devices, AI-powered IoT is increasingly becoming important across a range of business areas. As a matter of fact, the next evolutionary step for IoT is to embrace AI and drive intelligent automation and decision-making.

How the Blend of IoT and AI Works

At its heart, IoT is all about machines with sensors implanted. These machines, over internet connectivity, transmit streams of data. All IoT devices inevitably follow five basic steps. They are:

- Create

- Communicate

- Aggregate

- Analyze

- Act

The ‘Act’ step solely depends on the ‘Analysis’ step that immediately precedes it. Therefore, the efficiency of an IoT device is determined by its Analysis step. This is the point where AI technology portrays a significant role. While IoT devices provide a multitude of data, AI offers both creativity and context to make smart actions. Therefore, businesses can make smart decisions when an unlimited stream of data delivered by IoT devices is analyzed by AI technology.

Surprising Benefits of AI-Powered IoT

Combining two disruptive technologies like AI and IoT brings a broader range of benefits for both businesses and consumers alike. Some of the most popular benefits are as follows:

Enhanced Efficiency in Enterprise Operations

ML capabilities of AI can crunch huge volumes of data from IoT devices and detect patterns that can’t be done with simple computing devices. It can also predict the enterprise operation conditions and bring solutions for ideal outcomes. Therefore, redundant and time-consuming business tasks are eliminated.

An Efficient Risk Management System

AI-Powered IoT helps businesses analyze and predict a broader set of risks and automate timely responses. It ensures efficient handling of financial loss, employee safety, and cyber-attacks.

Brings Out Innovative Products And Services

A prominent AI technology like Natural Language Processing (NLP) is getting better at letting people communicate easily with computing devices. This leads to the creation of innovative products and services yet enhances the existing ones.

Enhanced Scalability

The AI-powered IoT ecosystem analyzes and crunches the data from devices ranging from smartphones to high-end computing devices to low-end sensors. This process can make large volumes of data handy and make it easier to share across a larger network of IoT devices.

Eliminates Unpredictable Yet Expensive Downtime

In some industrial sectors like offshore oil and gas, as well as industrial manufacturing, unpredictable equipment failures can bring expensive downtime. AI-enabled IoT allows you to predict equipment breakdowns and schedule timely maintenance procedures.

Generally, IoT combined with AI technology can lead the path towards an advanced level of business solutions and user experiences. To achieve greater value from your enterprise network and to transform your business, you should undeniably integrate AI with IoT devices.

Recent Posts

December, 2021

For running a business safely and securely in the cloud, you have to comply with a certain set of rules. This set of rules or policies that govern your business in the cloud environment are referred to as cloud governance. Typically, these policies share many similarities with those governing on-premise IT infrastructures.

These rules are focused on enhancing privacy, data security, and managing risks in order to secure the data and ensure the smooth operation of the application. In addition to enhancing and optimizing security and efficiency, cloud governance best practices also help economize a business’ finances by allowing it to do more with less usage of resources.

Is Changing Your Current Governance Strategy Necessary?

Since every IT business has governance protocols and strategies, you might be wondering: why must I change my existing governance framework? Is it inadequate to handle problems raised by shifting to a cloud environment?

Well, the shorter version of that answer is, Yes. That is because the traditional IT governance framework is based on using centralized tools custom-made for workers of specific departments. Although this approach is best suited for centralized tools, the cloud environment and its operations by nature are decentralized.

A cloud governance strategy allows for creating a standardized policy that can be followed by various employees and departments of the business irrespective of their roles or subdivisions.

This strategy enables every employee to share and be on an equal footing while working in the cloud environment. The cloud, like enterprise infrastructure, needs bodies that govern its environment and standardize its services and other shared infrastructure issues.

Five Pillars of Cloud Governance

The efficiency of cloud installation is definitely dependent upon the organization’s systems and procedures. However, they also impact the structure of their platform and its underlying architecture. Based on the following five pillars, one can effectively implement designs that ensure scalability.

Operational Excellence

This pillar focuses on your workload operating as desired, monitoring every process and system to yield higher business value and continuously improve them. To ensure that your workload runs effectively with governance principles, operations will have to be performed as per code, incremental development of applications, and continuous refinement of processes involved.

Reliability

Reliability focuses on ensuring that your application performs as desired and that it does so continually without encountering a complete failure. Even the most reliable applications encounter failures, but they can recover quickly to meet customer demand. This is because their workloads are distributed, and the only resources they utilize are the ones that are required for production workloads.

Performance Efficiency

Performance efficiency is all about using technical resources efficiently for increasing business returns and operational efficiency. An example of such can be the usage of serverless platforms for app deployment. You can also deploy your workload across a vast region so customers accessing it globally can experience quicker interaction.

Security

This fourth pillar focuses on protecting the confidential information, data, and systems of your business. It urges you to secure your applications by implementing strong identification protocols and access controls

Cost Optimization

The last focuses on optimizing and reducing the operational and up-front costs of cloud development for your business, along with a monitored and streamlined usage of resources. It recommends that you focus on core development activities while outsourcing all the ancillary services to a third-party vendor to reduce the time taken for development and corresponding costs.

To learn more about each pillar in detail, download our whitepaper here.

Cloud Security Governance Challenges

Following are some of the practical use cases of cloud governance strategies and how they help tackle governance challenges.

Safeguarding Against Eventualities

When a business avails cloud services from a vendor, it is the responsibility of the service provider to provide continuous and reliable services. It is also their responsibility to enhance said services. If the vendor’s service goes down, so will be the performance of the client. Having a proper cloud governance model in place helps avoid such situations.

Cost-Effectiveness

Cloud development is an extremely cost-effective approach to application making, and with the right governance policies in place, the business can reap huge profits. A well-optimized cloud governance model can run far more efficient financial analytics and yield an optimal way of automating these policies. It can also retain management reporting to help with cost management.

Data Security

Securing your data is one of the top priorities of any IT business, and a well-planned cloud strategy can secure you against hackers exploiting loopholes. Cloud governance policies and best practices dictate that you build a robust authenticating system to safeguard your confidential information. The reason behind such a strict rule is that cloud service providers such as AWS have many inherent security bugs.

At GoDgtl, we help businesses establish robust cloud governance frameworks for hybrid, cloud, and multi-cloud environments, enabling companies to maintain compliance, democratize data, and support collaboration.

Get in touch with our data modernization team to learn more about how we can help your company build a solid data governance framework.

Recent Posts

December, 2021